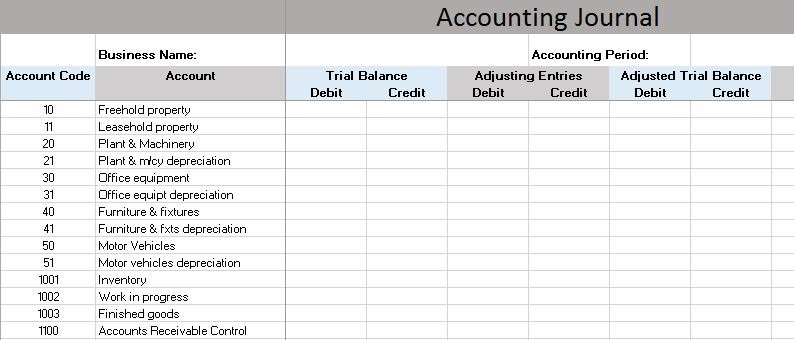

This is why it is essential to have a comprehensive understanding of this fundamental concept before you start to use MS Excel as a general ledger for your small business. You may know that the general ledger tends to use double-entry bookkeeping in order to keep track of all your small business transactions. Note that the next columns will mention each of the accounts that you will use during the year. You should know that a simple record-keeping setup will consist of columns for things like the date of transaction, transaction description, as well as a reference number, like an invoice or check number.

However, it is worth noting that every small business is different and will, therefore, have unique and different financial reporting needs.ĭetermining what accounting metrics you will need to include based on your small business is the first and most important step in setting up your bookkeeping process. And you can use the General Ledger to derive various reports, like the income statement. Keep in mind that these accounting entries from their specific accounts create the General Ledger.

These businesses also maintain a journal of all their daily transactions, known as the General Journal.ĭid you know that the General Journal entries record individual financial transactions in chronological order as either debits or credits? You can directly enter these entries into an MS Excel worksheet or import them from any other application into Excel. You may know that many small business owners in the US use an Excel accounting template when starting operations.

0 kommentar(er)

0 kommentar(er)